International Trade Finance

Horizon is excited to announce our partnership with Euro Exim Bank to offer trade finance solutions to businesses throughout Africa.

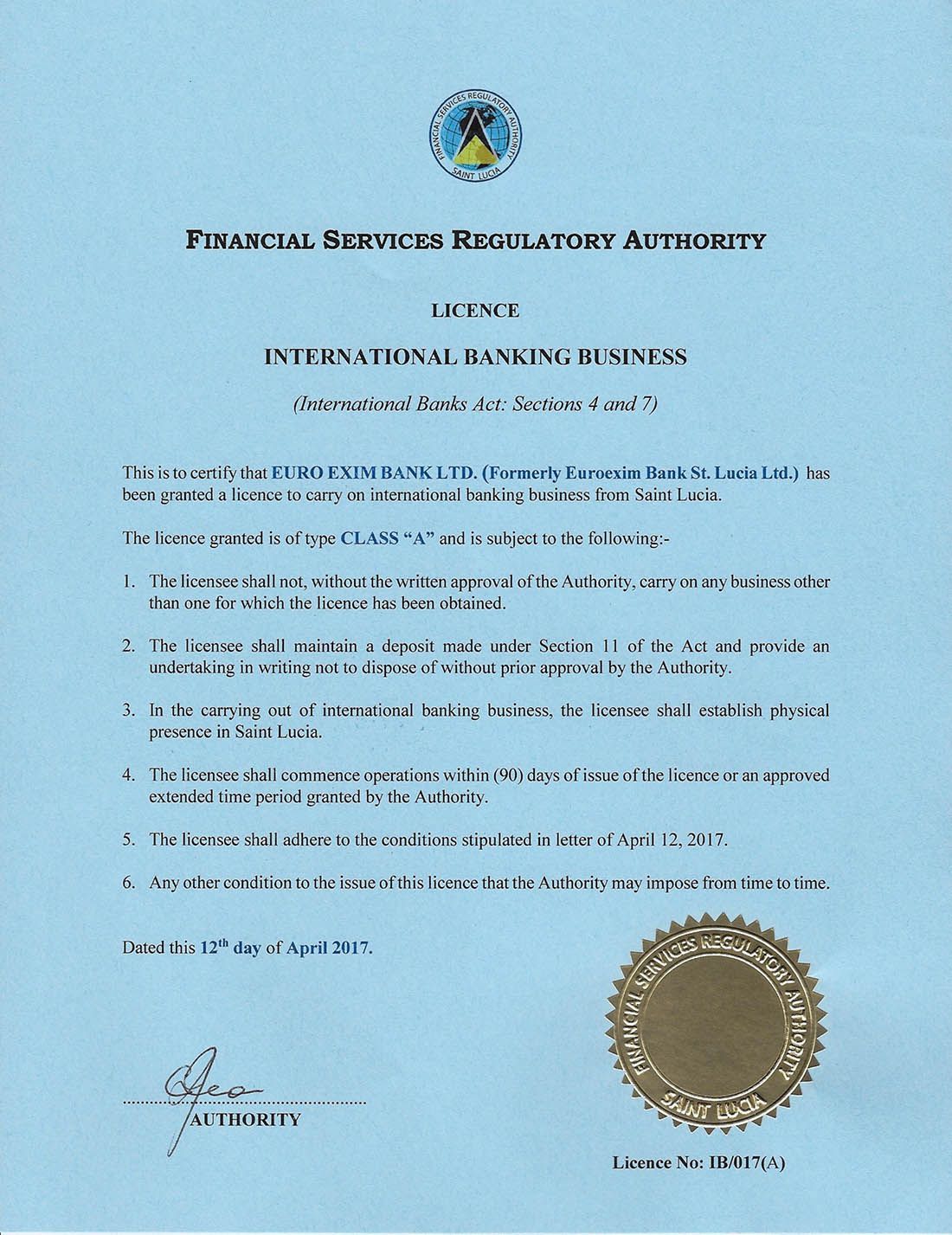

Euro Exim Bank Limited stands as an innovative global financial institution, proudly headquartered in St. Lucia, with a representative office in London. We possess a "Class A" international banking license granted by the Financial Services Regulatory Authority (FSRA) of St. Lucia. This prestigious license empowers us to engage in business with diverse third parties across various industries and global regions, underscoring our commitment to rigorous due diligence, comprehensive compliance, and operational excellence in all our processes.

As an associate member of the Caribbean Association of Banks Inc (CAB), Euro Exim Bank enjoys invaluable opportunities for collaboration and knowledge exchange with industry leaders. This affiliation plays a crucial role in modernizing our operations and enhancing our customer service.

We implement a robust Anti-Money Laundering (AML) framework, supplemented by thorough compliance policies and an extensive Know Your Customer (KYC) process. Our skilled team of specialists is exceptionally trained to identify, deter, and avert the misuse of Euro Exim Bank for illegal activities. Additionally, we leverage cutting-edge technology to facilitate seamless payment processing and the issuance of trade finance instruments from a single platform, ensuring timeliness and efficiency.

Our Services

Letter of Credit

A letter of credit is a financial document issued by a bank that serves as a guarantee of payment to a seller on behalf of a buyer. This document provides assurance that the seller will receive the specified amount of money, provided that they meet certain conditions outlined in the letter. Typically used in international trade transactions, a letter of credit acts as a safeguard for both parties, helping to facilitate trust and reduce the risk of non-payment or fraud in the process.

Standby Letter of Credit

A standby letter of credit (SBLC) serves as a payment guarantee issued by a bank on behalf of a client, acting as a "payment of last resort" in the event that the client does not meet their contractual obligations to a third party.

Standby letters of credit are established as a demonstration of good faith in business dealings and serve as evidence of a buyer’s creditworthiness and ability to repay.

The financial institution that issues the SBLC conducts necessary compliance checks and a brief underwriting process to validate the credit quality of the applicant, subsequently notifying the bank of the party requesting the letter of credit, typically a seller or creditor.

Crucially, when seeking an SBLC, a business owner must demonstrate to the bank their capacity to repay the loan. To secure the bank in case of default, collateral such as promissory notes, post-dated checks, and escrow deposits will be required. Additionally, the business owner is responsible for paying a SBLC fee for each year the letter remains valid, with the negotiable fee generally ranging from 5-10% of the SBLC's value.

Bank Guarantee and Tender Guarantee

A bank guarantee is a formal commitment made by a bank, assuring that it will cover a financial loss in the event that a borrower defaults on a loan or fails to meet the stipulated obligations under their loan agreement. This promise provides a safety net for lenders, reassuring them that they will not suffer financial detriment if the borrower is unable to fulfill their repayment responsibilities. In essence, the bank takes on the risk and acts as a guarantor, enhancing the borrower's credibility and facilitating broader access to credit.

Blocked Funds

Blocked funds services are specialized offerings provided by banks that involve restricting access to a certain amount of funds in an account for a specific purpose. This means that a portion of the account balance is reserved and cannot be used for general transactions or withdrawals. The reasons for blocking these funds can vary, often including securing a loan, fulfilling contractual obligations, or preventing overdrafts during a pending financial transaction. By utilizing these services, customers can ensure that the designated funds are safeguarded for their intended use, thereby facilitating smoother financial management and planning.

Bank Comfort Letter

A bank comfort letter is an important document issued by a financial institution that provides assurances to a third party regarding the financial soundness and stability of a particular individual or company. This letter typically outlines the bank's confidence in the financial health of the entity in question, often including relevant financial details or a summary of the individual or company's creditworthiness. By doing so, it serves as a valuable tool in facilitating business transactions, negotiations, or agreements, helping to build trust between the involved parties.

Proof of Funds

Proof of funds is a crucial document or statement issued by a recognized financial institution that serves to verify an individual or entity's financial standing. This document confirms that the person or organization in question possesses a specific amount of money that is readily available for use. It is often required in various financial transactions, such as real estate purchases or loan applications, to assure the involved parties of the individual's or entity's financial capacity to proceed with the transaction at hand.

Performance Bonds & Guarantees

A performance bond, issued by a bank or insurance company, ensures a contractor will fulfill their contractual obligations. If the contractor fails, the buyer can claim compensation up to the bond amount. This is common in international trade and high-value projects such as construction, mining, and energy.

Benefits of Performance Bonds in International Trade:

1. Provides Security to Buyers: Performance bonds ensure project completion as agreed, allowing buyers to recover losses.

2. Increases Credibility: Performance bonds enhance contractors' credibility and competitiveness for large contracts.

3. Facilitates Transactions: They reduce risk for buyers in cross-border trade, boosting confidence and easing negotiations.

4. Reduces Risks: Performance bonds protect against contractor defaults, crucial in high-stakes sectors where failures can cause delays.

Export Factoring

Export bill factoring helps exporters manage cash flow by selling invoices to a third-party factor. This process is essential in international trade. Here’s a brief overview:

1. Exporter Ships Goods: The exporter sends goods to an overseas buyer and generates an invoice with payment terms of weeks or months.

2. Assigns Invoice to Factor: Rather than waiting for payment, the exporter sells the invoice to a factoring company at a discount, receiving 70% to 90% of its value for quick capital.

3. Factor Waits for Payment: The factor collects payment directly from the buyer as per the original terms.

4. Settlement and Balance Payment: After receiving payment, the factor deducts fees and pays the exporter the remaining balance.

5. Improved Cash Flow:

Exporters get immediate working capital, avoiding payment delays.

Unlock Financial Growth: Discover Euro Exim Bank's Advantages Today!

Advantages of Utilizing Euro Exim Bank's Services:

- Enhanced Cash Flow: By leveraging trade finance instruments, companies can improve their cash flow management, ensuring they possess the vital funds required for operational growth.

- Risk Reduction: Tools such as Letters of Credit and Bank Guarantees assist in minimizing the risks tied to international trade, offering security and confidence for both buyers and sellers.

- Increased Credibility: Partnering with a reputable institution like Euro Exim Bank can elevate a business's credibility and reliability in the eyes of global partners.

- Access to Knowledge: Organizations can gain from the bank's extensive knowledge of international trade laws, regulations, and optimal practices, ensuring compliance and minimizing legal risks.

- Operational Streamlining: The bank's effective processing capabilities and technological solutions enable businesses to conserve time and resources, allowing them to concentrate on core functions and strategic expansion.

In conclusion, Euro Exim Bank provides a suite of specialized, efficient, and customer-centric financial services that can greatly benefit businesses engaged in international trade, enhancing their financial resilience, operational effectiveness, and overall growth potential.

Why choose Exim Euro Bank

Euro Exim Bank, a global financial institution, provides numerous advantages that position it as a top choice for businesses, particularly those engaged in international trade. Below are some reasons why Euro Exim Bank may be deemed superior, along with the benefits of utilizing its services.

1. Specialization in Trade Finance

Euro Exim Bank is focused on trade finance, offering customized solutions for both importers and exporters. Their services encompass Letters of Credit (LC), Standby Letters of Credit (SBLC), and Bank Guarantees (BG). With their expertise, they facilitate trade transactions, reduce risks, and ensure seamless operations.

2. Quick and Efficient Service

Euro Exim Bank is recognized for its quick processing times. They utilize technology to guarantee that documentation and approval processes are streamlined, an essential factor for businesses requiring prompt financial assistance to support their trade activities.

3. Global Reach

Euro Exim Bank boasts a robust international network, with a presence in various countries. This global footprint is advantageous for businesses operating across borders, facilitating smoother coordination and execution of international transactions.

4. Innovative Technology

The bank utilizes state-of-the-art technology to deliver secure and efficient financial services. By incorporating blockchain technology, for example, they bolster transparency and security in trade finance, minimizing the risk of fraud while accelerating transaction speeds.

5. Customer-Centric Approach

Euro Exim Bank prioritizes a deep understanding of its clients' distinct needs, delivering tailored solutions to match. This client-focused strategy guarantees that businesses obtain the precise assistance they need, whether related to financing, risk management, or trade facilitation.

6. Flexible Financial Solutions

The bank provides adaptable financing options designed to meet the unique needs of businesses. This encompasses both short-term and long-term financing solutions, which can be tailored according to the trade cycle and the financial requirements of each business.

7. Expertise and Experience

Euro Exim Bank, backed by a team of seasoned professionals, offers a rich reservoir of knowledge in international trade and finance. Their specialized expertise aids businesses in maneuvering the intricacies of global trade, ensuring compliance while enhancing financial performance.

8. Cost-Effective Services

The bank is committed to delivering affordable financial solutions that enable businesses to handle their finances with greater efficiency. With competitive rates and clear fee structures, their services are both accessible and budget-friendly for small and medium-sized enterprises (SMEs) as well as large corporations.

EEB Disclaimer - Read more

Euro Exim Bank Limited is a Group of Companies with Registered Office in Saint Lucia and a Representative Office in the United Kingdom. EURO EXIM BANK LTD (REGISTERED OFFICE) is a Class A International Banking Financial institution incorporated under the revised laws of St. Lucia. The license provides authorisation to conduct business with third parties across industries and geographies worldwide. This office is regulated by the Financial Services Regulatory Authority in St. Lucia, and does not provide any services to any natural person or legal entity in St. Lucia.

EURO EXIM BANK LIMITED (REPRESENTATIVE OFFICE) is incorporated under the laws of England and Wales with company registration number 07520196. This entity is a non-banking financial institution that facilitates international business transactions through issuance and relay of various trade finance instruments. The London-based Representative Office offers Letters of Credit and Standby Letters of Credit to corporate clients only. This office does not provide regulated or controlled services or activities.

Important Notice: Euro Exim Bank Ltd would like to advise its customers to report any suspicions which they may have regarding the identity of any intermediary who promotes products or services of the Bank or any intermediary bearing similar names. You should verify with Euro Exim Bank by calling the Bank's Customer Service Number on +44 208 207 2868 or emailing info@euroeximbank.com. Please also be aware of bogus SMS messages and voice message calls or fraudsters who misrepresent services and impersonate the staff of Euro Exim Bank.